Securitised Credit

Executive summary

- Unlike traditional bonds, Securitised Credit cash flows are generated from a specific pool of collateral backing the bond. Several types of collateral are used to back Securitised Credit. These include residential mortgages, commercial mortgages, credit-card receivables, auto loans and leveraged loans

- Securitised Credit offers a number of advantages to investors, including a relatively high income, a low correlation with other asset classes (including fixed income), access to assets that are otherwise difficult to gain exposure to, and the ability to dial up and down the risk spectrum according to an investor’s specific needs and risk appetite. The asset class’s floating-rate nature can also provide a cushion against duration volatility

- Moreover, regulations and oversight have changed significantly since 2008, and concerns over the whole asset class seem unfounded. Consequently, institutional investors continue to allocate to Securitised Credit; it has a distinct appeal to multi-asset allocators in particular

- HSBC Asset Management (HSBC AM) has a long and successful track record in the sector, and our dedicated, experienced team of investment professionals adopt a dynamic, global approach that has stood the test of time

Introducing Securitised Credit

The Securitised Credit sector is composed of bonds underpinned by cash-generating assets such as residential mortgage loans, commercial mortgage loans, credit-card loans, auto loans and leveraged loans. These illiquid cash-generating assets are purchased and restructured into various tranches of securitised assets by issuers such as financial institutions, and are then sold to investors as tradeable assets. So, the key feature of the asset class is the ability to access an illiquid loan portfolio in a liquid format. Investors receive cash flow and gain exposure to asset classes that are difficult for them to access directly, such as residential mortgages, which are originated by banks.

The various tranches enjoy different levels of priority over the cash flows from the loan portfolio. The most senior notes receive payment first and suffer losses last. Consequently, they have the highest credit rating and pay the lowest coupon, as they are deemed the least risky. The most junior bonds receive payments only when all senior notes have received payment and suffer any losses first. These junior tranches are consequently riskier, receive lower credit ratings, and pay more to compensate for this risk.

In addition, the interest on the loan portfolio exceeds the interest cost on the bonds, giving an element of excess spread – even to the most junior tranche – to cushion against loan losses.

Figure 1: The differences between Securitised Credit and bonds

Bonds

- Generally, coupon payments are fixed rate and paid periodically and principal paid at maturity

- Cash flow to repay bonds generated from issuer’s underlying business activity (e.g. HSBC will pay its bonds from revenue generated)

- Maturity dates are usually fixed, with all the principal received on the maturity date

- Untranched – all holders of the bond receive payments and suffer losses equally

- Credit rating depends on ability of the issuer to repay the bond

Securitised Credit

- Coupons tend to be floating rate, offering a margin above a reference rate (e.g. SOFR), paid periodically

- Cash flows to pay notes (each tranche) generated from underlying collateral (e.g. the repayments on mortgages)

- Life of the security depends on collateral characteristics such as principal prepayment and default rates and structural features such as call/refinancing options. ABS are often amortising, meaning that principal is repaid over the life of the instrument

- Tranched – note holders receive payments and suffer losses depending on how senior their note is

- Credit ratings for each tranche depends on the tranche’s probability of suffering losses, which depends on underlying collateral and structure of the securities (e.g., how much credit enhancement there is to protect against losses)

Source: HSBC Asset Management, 31 July 2025.

The advantages of Securitised Credit

High income

High income

Securitised Credit has historically paid higher income than traditional corporate credit’, generated by two elements:

- Coupons tend to be floating-rate in nature, offering a margin above a reference rate, such as the Secured Overnight Financing Rate, paid periodically. As a result of the floating-rate characteristic, coupons (which increase as interest rates rise) are higher than those associated with more traditional forms of fixed income

- In addition, investors receive a credit spread, which has always exceeded that payable by corporate bonds

Diversification benefits

Diversification benefits

The sector benefits from a low correlation with traditional asset classes, such as US equities and fixed income. The predominantly floating-rate nature of the asset class means it is not exposed to duration risk, and so performance varies from other asset classes during economic cycles, offering an alternative source of risk-adjusted returns.

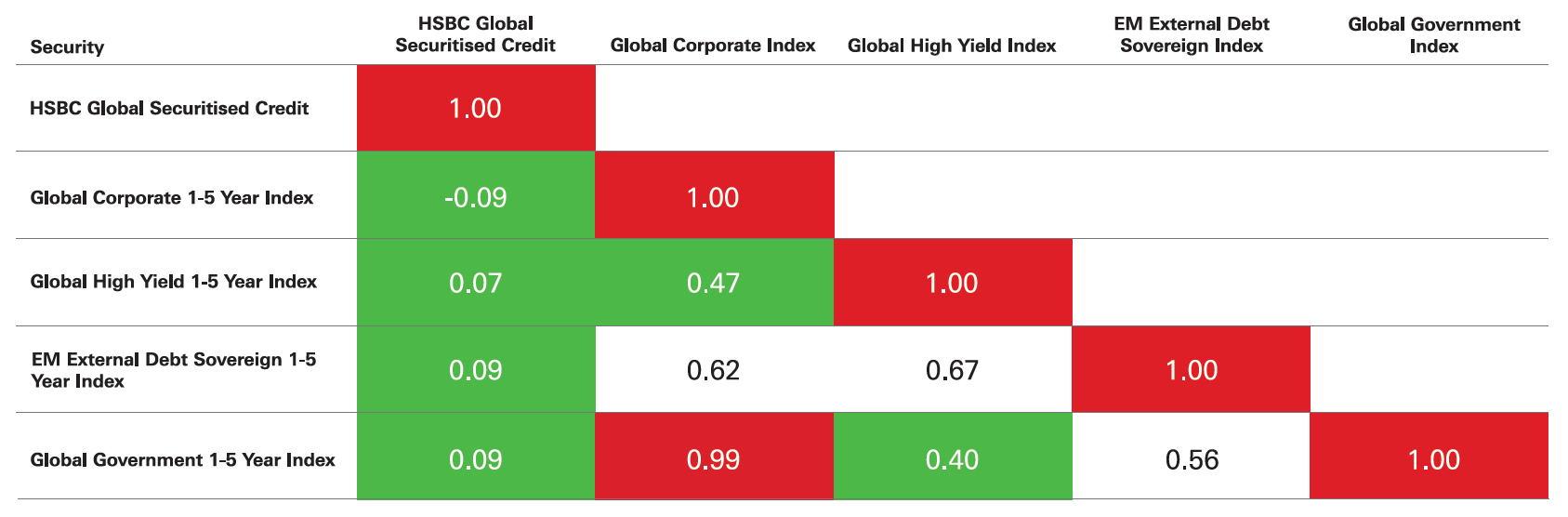

Over the longer term, Securitised Credit has shown superior performance and lower volatility than traditional fixed income specifically. Indeed, Securitised Credit has a low correlation with all sub-classes of traditional fixed income when looking at both global and regional indices.

This reflects the asset class’s unique return, volatility and duration profile. That characteristic – and its low correlation with the likes of US equities – makes the asset class particularly attractive to multi-asset allocators.

Figure 2: Correlation with traditional fixed income is low

Source: Bloomberg, HSBC Asset Management Performance datas for the HSBC Global Investment Grade Securitised Credit fund, ICE BofA Global Corporate Index, ICE BofA Global High Yield Index, ICE BofA EM External Debt Sovereign Index and ICE BofA Global Government Index are for the period May 2019 to May 2024 on a monthly basis.

Credit exposure

Credit exposure

The asset class is specifically a credit offering. Therefore, investors are able to choose the level of risk that suits their risk/return targets within the spectrum of credit securities. There is also the potential for spread compression as an additional layer of returns.

Attractive valuations

Attractive valuations

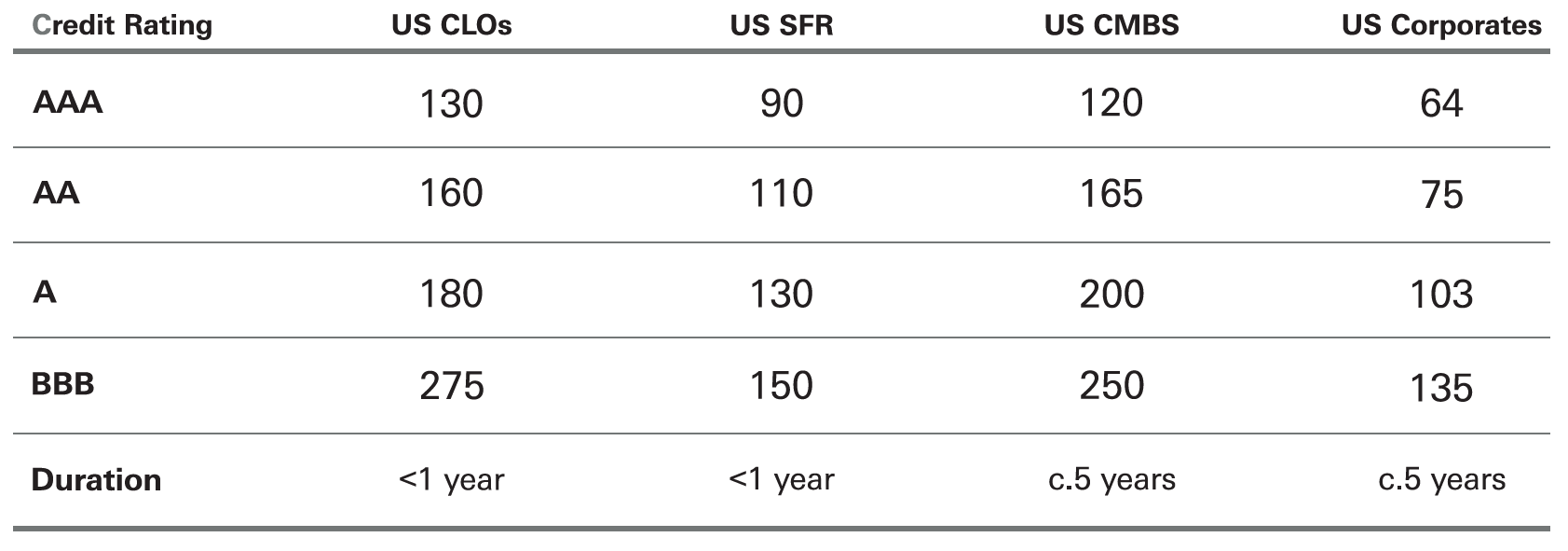

The three largest Securitised Credit sectors – Collateralised Loan Obligations (CLOs), Commercial Mortgage-Backed Securities (CMBS) and Residential Mortgage-Backed Securities (RMBS), which together account for approximately 70 per cent of all Securitised Credit outstanding – demonstrate the highly attractive valuations offered by the asset class when compared with similarly-rated corporate bonds.

Figure 3: Spreads above Libor (bps) by main Securitised Credit sectors and US corporates

Source: Securitised Credit spreads – HSBC Asset Management. USD Corporate Bond Spreads AAA to BBB – Bank of America Merrill Lynch 5-7 year US corporate indices AAA to BBB. Non-IG US Corporates – Bank of America Merrill Lynch US High Yield Index. Data as at 31 July 2025.

Why diversification is particularly relevant in the current environment?

The significantly different return profile of Securitised Credit when compared with traditional fixed income, and its lack of exposure to duration, is the main driver of risk-adjusted returns. Higher interest rates (leading to higher income levels) and resilient economic growth (resulting in lower spreads as a result of improving credit fundamentals) provide the most accommodative environment for the asset class, allowing investors to benefit from both income and capital appreciation.

The economic uncertainty generated by US trade policies – and the likelihood that those tariffs will generate higher inflation – suggests that it will be more difficult for central banks to cut interest rates than would otherwise have been the case. The chairman of the Federal Reserve, Jerome Powell, highlighted the challenges facing the Fed in September 2025, when he described its interest-rate stance as “still moderately restrictive” and highlighted the difficulty of balancing concerns around the softening labour market with the inflation risk.

The possibility that interest rates will remain higher for longer than anticipated will support the relatively high income stream generated by Securitised Credit, while the credit enhancement offered by the asset class offers investors protection against the global economic shock caused by US trade policies. Certainly, Securitised Credit performs very well in a shallow recession, so it should fare relatively well in the current environment.

In addition, the uncertain economic outlook is likely to elevate credit spreads. It will certainly prove difficult for spreads to tighten in this environment, further supporting high income into the future, along with a degree of credit protection.

Recession risks

Naturally, some investors may still have concerns about taking on exposure to borrowers, given the potential for a global economic slowdown or recession at a time when borrowing costs are likely to remain relatively high and weigh on debt servicing costs.

However, this is where the great advantage of Securitised Credit – being able to choose the particular level of risk you wish to be exposed to – comes to the fore. Against a background of deteriorating economic activity and elevated borrowing costs, investors may choose to focus on the most senior tranche, which is essentially AAA-rated and has a very large amount of credit enhancement.

Conversely, investors may prefer to take on more risk in anticipation of a higher return by gaining exposure to a more junior tranche that is less highly rated.

In short, Securitised Credit provides an effective means of calibrating risk and return.

Addressing liquidity concerns

Some investors may still harbour concerns about the financial engineering involved in taking an illiquid asset class and making it more liquid, particularly given that the 2008 global financial crisis remains fresh in many people’s memories. That crisis resulted in Securitised Credit being labelled ‘toxic’ following widespread defaults in the US housing market and the subsequent losses suffered by holders of US sub-prime RMBS and CDOs. However, the events of 2008 led regulators to pay attention to the entire industry. Extensive legislation has since been passed, bringing greater investor protection and improved transparency, which itself allows for a more informed perception of risk.

Moreover, it is important to note that the higher returns generated by Securitised Credit reflect the complexity or credit risk, as well as the liquidity risk. While Securitised Credit is much more liquid than the underlying loans, it is less liquid than corporate credit, which also does not involve the same level of complexity.

How HSBC manages liquidity risk?

Currently, the market is relatively liquid at the senior tranche level, with around USD2.4 billion of AAA-rated paper traded every day in the US alone . We offer daily dealing in our most highly rated strategy, while the high-yield strategy is less liquid, with weekly dealing. We manage liquidity risk very carefully, calibrating the liquidity of our fund offerings to recognise the potential dangers.

The funds were set up in 2010 and have successfully navigated a variety of challenging environments. So, the liquidity of our funds has been tested regularly, and has passed those examinations.

Why choose HSBC AM for Securitised Credit?

We have one of the largest and most experienced dedicated securitised-credit teams in the market, composed of 11 investment professionals. Our 15-year track record of success highlights our ability to manage complexity or credit risk and liquidity risk.

The core of our team focuses on credit-risk analysis. We also employ portfolio managers dedicated to controlling liquidity risk.

One of the key differentiators between HSBC AM and our competitors is our global dynamic allocation approach. We acknowledge that there are distinct differences in the way Securitised Credit operates in key markets such as the US and Europe.

The RMBS sector, excluding US agency mortgage-backed securities, provides an example of our different approaches in the US and Europe. The US dominates the overall market, accounting for around 70 per cent of its value. Clearly, different economic factors affect these two markets, and it is important to recognise that Europe, including the UK, offers different value opportunities than the US. This is reflected in the credit analysis we conduct.

Every month, the team meets to pinpoint where the best opportunities can be found across the US and Europe. We adjust the portfolio accordingly, subject to liquidity constraints, so that it is optimally placed to generate stable returns.

In conclusion, Securitised Credit offers investors a compelling income, a hedge from duration volatility, and the potential for further returns through spread compression. For a strategic asset allocator, the unique return profile, low correlations with traditional asset classes, and superior Sharpe Ratios are important considerations. In addition, the sector has evolved significantly since the global financial crisis, and has proved resilient since HSBC AM first entered it in 2010.

Source: HSBC Asset Management, as at 31 July 2025.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. The views expressed above were held at the time of preparation and are subject to change without notice. This information should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security.

Key risks

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

- Interest rate risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements.

- Counterparty risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

- Credit risk: Issuers of debt securities may fail to meet their regular interest and/or capital repayment obligation. All credit instruments therefore have the potential for default. Higher yielding securities are more likely to default.

- Default risk: The issuers

- Emerging markets risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

- Exchange rate risk: Investing in assets denominated in a currency other than that of the investor’s own currency perspective exposes the value of the investment to exchange rate fluctuations.

- Investment leverage risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

- Asset Backed Securities (ABS) risk: ABS are typically constructed from pools of assets (e.g. mortgages) that individually have an option for early settlement or extension and have potential for default. Cash flow terms of the ABS may change and significantly impact both the value and liquidity of the contract.

- Derivatives risk: The value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivative. Unlike exchange traded derivatives, over-the-counter (OTC) derivatives have credit risk associated with the counterparty or institution facilitating the trade.

- High yield risk: Higher yielding debt securities characteristically bear greater credit risk than investment grade and/or government securities.

- Liquidity risk: Liquidity is a measure of how easily an investment can be converted to cash without a loss of capital and/or income in the process. The value of assets may be significantly impacted by liquidity risk during adverse markets conditions.

- Operational risk: The main risks are related to systems and process failures. Investment processes are overseen by independent risk functions which are subject to independent audit and supervised by regulators.

Further information on the potential risks can be found in the governing documents.