Securitised Credit

Synopsis

- Collateralised Loan Obligations (CLOs) are floating rate securities, providing investors with attractive levels of income.

- CLOs are performing strongly in the current macroeconomic environment.

- Manager and Security Selection is key in this sector. We believe broadly syndicated CLOs sponsored by high-quality CLO managers offer attractive risk-adjusted returns and are our preferred investment versus mid-market loan CLOs and commercial real estate loan CLOs.

- Credit enhancement behind the senior tranches provides investors with a significant cushion against collateral losses and senior tranches are best placed to navigate any market volatility.

- Tranches allow investors to choose their level of risk, along with where they want to allocate across senior, subordinated and equity tranches.

- Demand for the asset class, as demonstrated by the strong CLO issuance during 2025, was well absorbed by the market and bodes well for the sector.

- CLOs offer a spread premium over similarly rated traditional fixed income corporates and diversification benefits given their unique cash flow profile and structure.

What is a CLO?

A CLO is a special purpose vehicle (SPV) backed by a pool of loans – typically leveraged loans that are issued to corporate entities. As of end October 2025, CLOs represent ~31 per cent (c.USD1.2tn) of the distributed Securitised Credit market.

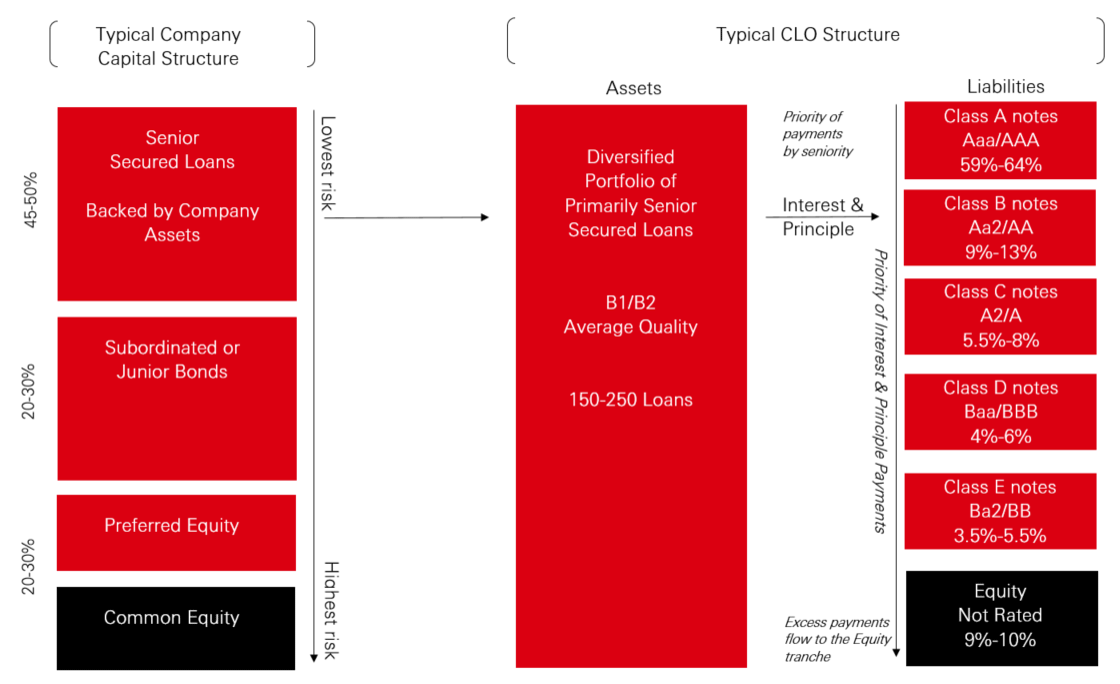

The below chart shows an illustrative structure of a CLO including the number of underlying leveraged loans to private companies, the different levels of risk comprising the CLO and the order of payments from these loans to the investors in different CLO tranches.

Typical CLO Structure

Source: HSBC Asset Management, LCD Global Review – US/Europe 2Q 2018 and LCD Loan Primer “Syndicated Loans: The Market and the Mechanics – 2017”

CLOs can offer investors diversification benefits versus equivalent rated corporate bonds due to lower correlations but also offer much more…

-

Floating rate: CLO securities pay investors a spread above a benchmark such as SOFR or EURIBOR. The spread is larger than for comparably rated corporate bonds and provide additional yield. The floating rate aspect means that elevated base rates provide attractive levels of income and, while the yield curve remains flat, significant benefit over longer duration bonds. The fact that the coupons change with rates means that this yield is paid as current running income.

-

Manager selection: Choosing the right CLO manager is fundamental to CLO investing. The CLO manager selects the different loans across various sectors that make up the CLO itself. Therefore, it is crucial that the loans selected are in the right sectors, are of high credit quality and are in full compliance with the terms/triggers and criteria of the CLO structure.

Dynamicity is also a key factor. An active CLO manager has the ability to spot warning signs in individual loans and sectors early and move the portfolio to lower risk sectors. Extracting the best opportunities allows the CLO manager to enrich risk-adjusted returns for investors.

It is our opinion that top tier institutional quality CLO managers are more likely to achieve this by selecting a diversified portfolio of high-quality loans across market sectors.

-

Tranches: Tranches create a capital structure within the CLO, allowing investors to allocate based upon their risk appetite across senior, subordinated and equity securities. Senior tranches receive principal and interest payments from the CLO first with subordinated and equity tranches receiving their payments only once the senior tranche above them has been paid. The lower tranches are also the first to absorb any losses realised within the structure.

-

Credit enhancement: The structural features of credit enhancement may provide an extra layer of protection in addition to the underlying collateral security before investors begin to suffer losses. Credit enhancement at the top tranches of the securitisation are higher now than in previous cycles. These include cash reserve funds, overcollateralisation (where the value of collateral exceeds the loan value) and excess spread (amount paid by CLO loan holders exceeds amount paid to investors).

-

Risk retention: Regulatory changes have symbiotically aligned issuer and investor interests in the CLO market, providing further protection to CLO investors. EU Risk Retention regulation forces CLO managers distributing in Europe to retain 5 per cent of the securitisation on the CLO manager balance sheet.

-

Prudent management: Typically, the CLO managers take exposure to the lowest quality equity tranche of a securitisation and are restricted to a maximum of 7.5 per cent allocation to CCC rated debt, further incentivising prudent management of the underlying assets.

Source: HSBC Asset Management, 31 October 2025. Diversification does not ensure a profit or protect against loss.

Size matters

When it comes to the CLO sector, size matters with regards to the corporates backing the loans, the CLO manager, and the syndication of the CLOs.

- Corporates: Typically, the underlying assets in CLOs we invest in are mostly Senior Secured/First Lien corporate loans (this means the CLO manager has a priority claim on the secured assets in event of a bankruptcy). These loans are all from established corporates that typically have an EBITDA greater than USD200mn. A CLO holds between 150–250 corporate loans.

- Type of CLO manager: As mentioned above, repeat-issue, top tier institutional quality CLO managers with experience in the market are most likely to outperform. Given this, it should come as no surprise that we utilise our enhanced due diligence procedure and our team’s length of time in the market to select the better performing managers. With roughly 150 CLO managers in the US CLO market, we only invest with a small selection of managers that we believe can unlock the opportunities and navigate the pitfalls in this asset class.

-

Broadly syndicated loans: CLOs at a broader level can be segregated into different types based on the underlying loan collateral. The main types are broadly syndicated loans (i.e. big loans to big companies, with many large institutions as investors behind the loan), smaller mid-market leveraged loans and commercial real estate (CRE) CLOs.

We only invest in CLOs backed by broadly syndicated loans and therefore avoid the higher credit risk associated with smaller mid-market firms and nuances involved with commercial real estate CLOs. Indeed, mid-market and CRE CLOs are already showing signs of distress. The size of the broadly syndicated loans market also facilitates sectoral diversity within the CLO portfolio, which we believe makes it the most attractive segment.

Selecting a manager with the right credit resources to make the best loan selection and manage the loan portfolio during the term of the CLO is critical: when interest rates are high (attractive coupons for investors), defaults and loan loss in the CLO might tick up because the high borrowing costs for the underlying companies.

Loan defaults are down year-to-date in both the US and Europe and are 1.53 per cent and 0.91 per cent respectively as of end September. Along-side our allocation to higher rated tranches (i.e. senior securities), our approach to CLO investing seems well suited to manage any potential increases in defaults as well as any possible credit deterioration within the underlying CLO collateral.

Source: HSBC Asset Management, 31 October 2025.

Why has 2025 been an important year for CLOs and what can we expect 2026 to bring?

Resilient economic data and inflation proving harder to tame for most of 2025 has delayed the Fed delivering rate cuts until recently, one in September and one in October. This has been supportive for floating rate CLOs which continue to offer attractive income from coupons.

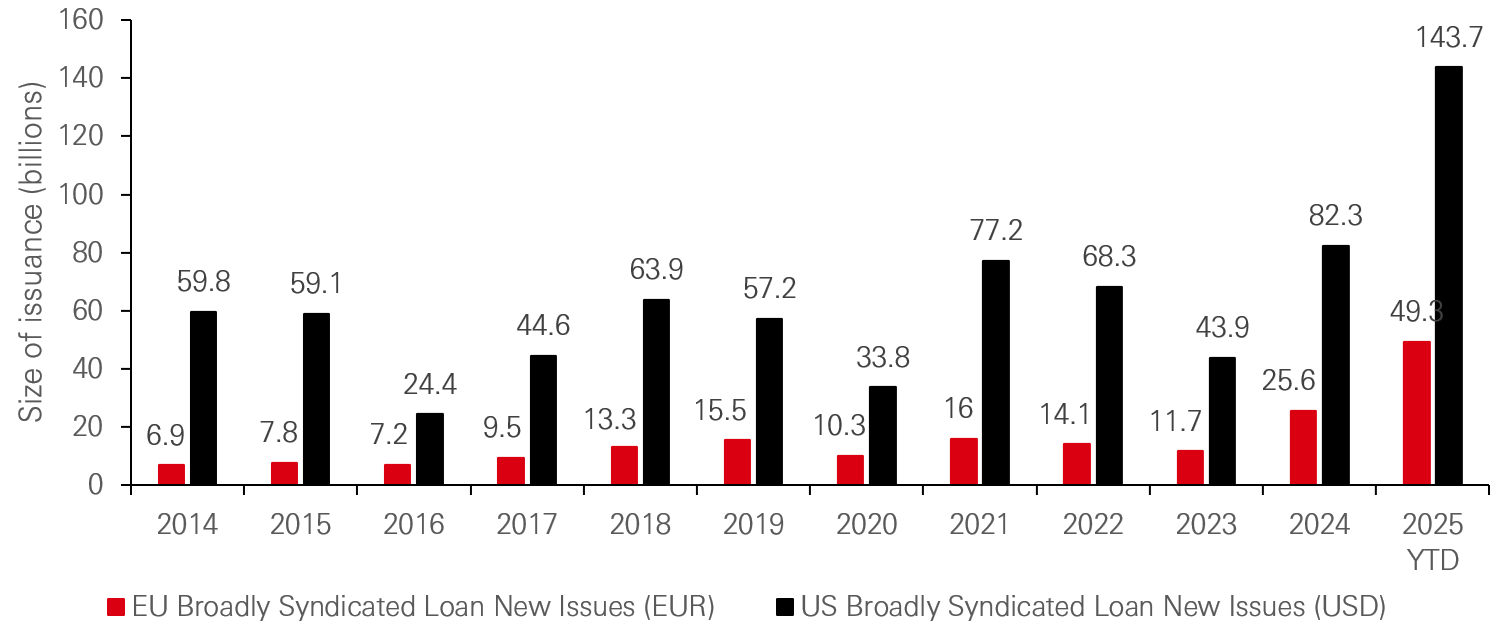

Demand for CLOs, given the market backdrop, has been sizeable and has been met with high levels of issuance. As can be seen below, 2025 Issuance has significantly outstripped historical issuance, with September reaching USD169.9bn of broadly syndicated CLO paper issuance. Demand has been outstripping supply for high quality loans.

This market demand is expected to remain strong, continuing into 2026, with institutional clients and investment banks continuing to make up the lion share of investment.

Broadly syndicated CLO loan issuance has soared to 10+ year highs

Source: HSBC Asset Management, Barclays as at 31 October 2025. The views expressed above were held at the time of preparation and are subject to change without notice. Past performance does not predict future returns.

Despite October’s news headlines of high-profile bankruptcies, we are not seeing any signs of systemic risk. Although the default rate of leveraged loans has ticked up from historically low levels in 2021, it remains well below the long run average of around 3 per cent p.a. (as of September 2025, it was 1.53 per cent in the US and 0.91 per cent in Europe). Even if default rates were to increase to longer term averages, this is far from a concern, given that we continue to invest solely in broadly syndicated CLOs, with a strong focus on institutional quality, repeat-issue CLO managers (we only invest with the top 15 out of 150 managers).

As long as inflation data allows it, we would expect the Fed to continue with further interest rate cuts into and throughout 2026. Given that CLOs are floating rate instruments, this would mean a reduction in the coupon payments. However, there are four points to note that suggest returns for CLOs remain attractive even with forecasted interest rate cuts:

- CLO securities will still generate high levels of income even as interest rates are lowered to more neutral levels; it is unlikely we are going back to the “lower for longer” environment of the past decade.

- Inflation remains a lingering concern and if it remains sticky, central banks will most likely have to pause interest rate cuts, meaning that income from CLOs would remain higher.

- Spreads on CLOs will always be higher than traditional corporates due to the complexity premiums on offer when evaluating pools of loans. These provide opportunities for investors to source high quality CLOs whilst earning a spread premium.

- Falling interest rates, including the recent Fed rate cuts, could mean spread tightening in the sector, due to improved corporate fundamentals, especially with the diversified corporates which make up the high-quality CLOs we invest in.

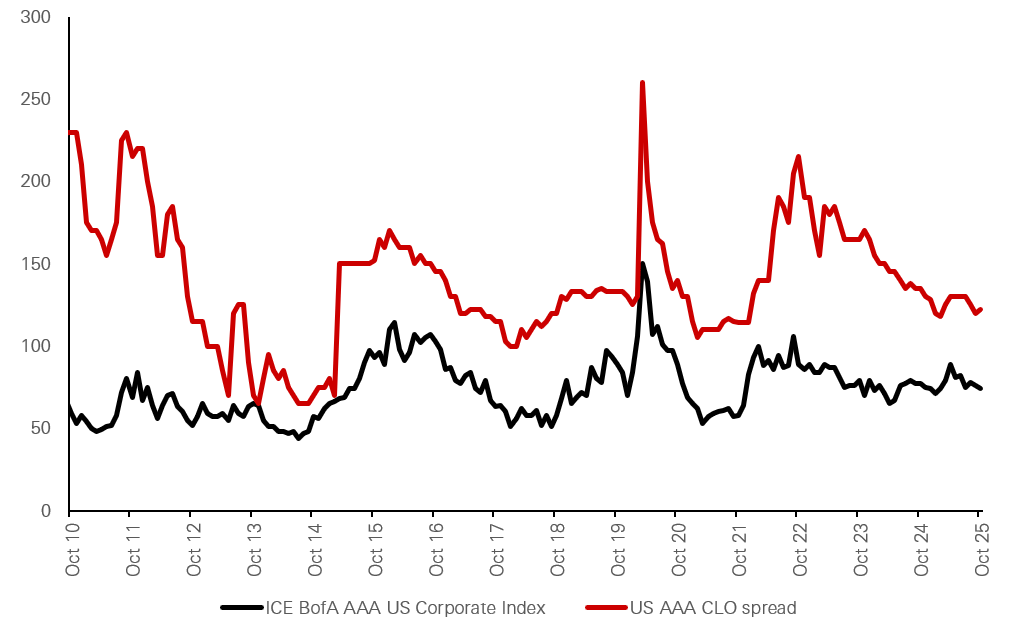

When we look at CLO spreads, they remain wide of their historic tights. The same cannot be said for traditional corporates which continue to test record tights.

What’s more is that CLOs will always provide a spread pick-up when compared to equivalent rated corporate bonds (which are at historical spread tights). One can argue from an asset allocation perspective that high quality CLOs are more attractive than high quality corporate bonds at this point in the cycle.

In fact, as can be seen below, in all instances within the below chart, AAA US CLOs offer a wider spread than AAA US corporate bonds, highlighting their attractiveness.

CLO spreads offer real premiums and can tighten further

Source: Bloomberg, JP Morgan, HSBC Asset Management, as at 31 October 2025.

Conclusion

CLOs continue to be an attractive proposition, and we believe they should be front and centre in the minds of institutional investors in this new paradigm of neutral interest rates. There is a yield pick up on offer as a result of interest rates remaining high, low correlations to traditional fixed income corporates given its unique cash flow profile and the opportunity for further returns through spread compression. However, extracting the returns and diversification benefits will hinge on manager selection which is of paramount importance. There is strong demand for the asset class as evidenced by the record levels of issuance and one could arguably have to look far and wide for a worthy alternative.

Key risks

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

- Interest rate risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements.

- Counterparty risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

- Credit risk: Issuers of debt securities may fail to meet their regular interest and/or capital repayment obligation. All credit instruments therefore have the potential for default. Higher yielding securities are more likely to default.

- Default risk: The issuers of certain bonds could become unwilling or unable to make payments on their bonds.

- Emerging markets risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

- Exchange rate risk: Investing in assets denominated in a currency other than that of the investor’s own currency perspective exposes the value of the investment to exchange rate fluctuations.

- Investment leverage risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

- Asset Backed Securities (ABS) risk: ABS are typically constructed from pools of assets (e.g. mortgages) that individually have an option for early settlement or extension and have potential for default. Cash flow terms of the ABS may change and significantly impact both the value and liquidity of the contract.

- Derivatives risk: The value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivative. Unlike exchange traded derivatives, over-the-counter (OTC) derivatives have credit risk associated with the counterparty or institution facilitating the trade.

- High yield risk: Higher yielding debt securities characteristically bear greater credit risk than investment grade and/or government securities.

- Liquidity risk: Liquidity is a measure of how easily an investment can be converted to cash without a loss of capital and/or income in the process. The value of assets may be significantly impacted by liquidity risk during adverse markets conditions.

- Operational risk: The main risks are related to systems and process failures. Investment processes are overseen by independent risk functions which are subject to independent audit and supervised by regulators.

Further information on the potential risks can be found in the governing documents.