Evergreen funds: What every private equity investor should know

Open-ended fund structures have democratised private equity, allowing private wealth investors access to an asset class that was once the preserve of large institutional investors. This article explains what evergreen funds are, why they are growing rapidly, and the role they could play in your portfolio.

What are evergreen funds?

For decades, private equity was targeted at institutional investors and came in one flavour – closed-ended drawdown funds, which typically have a 10-15-year lifespan. Investors commit a significant amount of capital that is drawn down over several years and invested in attractive target companies (often via leveraged buyouts). While the traditional model continues to deliver attractive long-term returns overall, recent years have seen the evolution of private equity with the growth of open-ended ‘evergreen’ funds.

Evergreen funds offer a perpetual structure, enabling ongoing investment and potential redemptions. Evergreen funds cater to new and individual investors by offering lower investment minimums and periodic liquidity. This provides an efficient solution for portfolio and cash flow management without the need to manage capital calls and distributions.

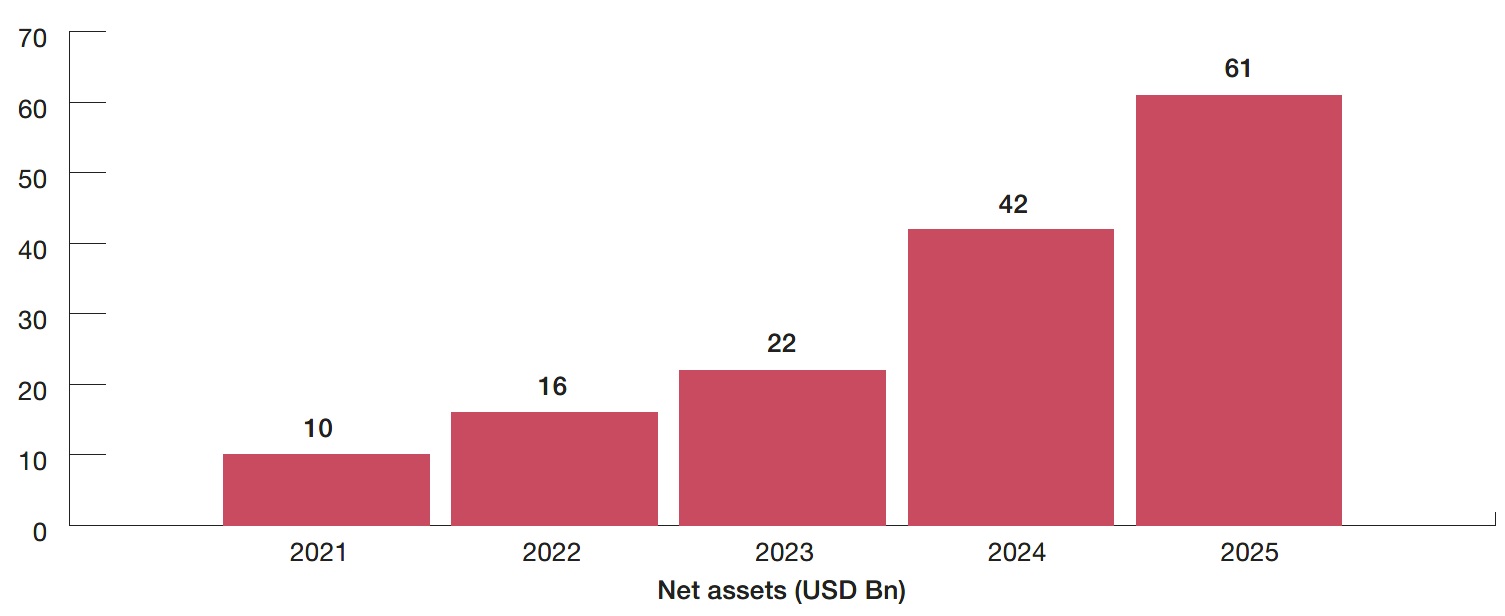

Private equity evergreen funds have proliferated significantly in recent years. As an indication, net assets in the largest US SEC-Registered private equity evergreen funds have grown six-fold in the last four years.

Figure 1: Net assets for largest 16 SEC-registered private equity-focused evergreen funds (2021-2025)

Source: Scientific Infra & Private Assets (2025). Data as at 31 March of each year.

This growth has been driven by the evolution of a diverse array of fund wrappers and platforms. These include tender-offer funds, interval funds, non-listed business development companies (BDCs), undertakings for collective investment (UCI) investment funds, and newer structures – the European Long-Term Investment Fund (ELTIF) and UK Long-Term Asset Fund (LTAF).

While the growth of evergreen funds has historically come from income-driven strategies (notably private credit and real estate), the evolution of the secondaries market and co-investment relationships has driven the expansion of evergreen private equity offerings. Recent years have seen a clear industry shift towards large managers launching dedicated evergreen fund products offering clients perpetual exposure and access.

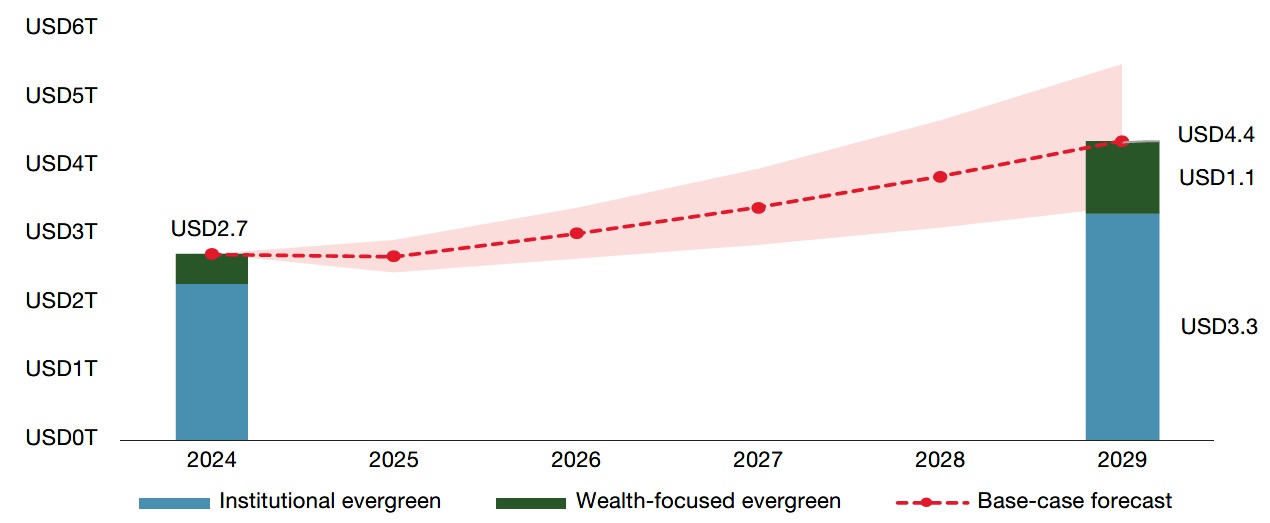

The chart below shows the expected growth in assets under management of evergreen funds over the next four years.

Figure 2: Evergreen fund AUM forecast (2024-2029)

Source: Pitchbook (2025).

According to Pitchbook, around USD 2.7tn was managed in various indefinite life formats globally at the end of 2024. This is projected to increase to USD 4.4tn by the end of 2029, with the proportion of wealth-focused evergreen AUM projected to increase from USD 0.4tn to USD 1.1tn, a compound annual growth rate of 22.4 per cent1.

The chart below breaks down evergreen vehicle activity by investment strategy over H1 2025.

Figure 3: Evergreen transaction volume by strategy (H1 2025)

Source: Campbell Lutyens (2025).

Buyout strategies remain dominant representing 70 per cent of evergreen fund allocations in H1 2025, with venture and growth equity at 12 per cent, and other private asset classes making up the remainder.

Evergreen funds come in two broad types2:

- Multi-manager funds: which include multi-strategy funds that allocate to a diversified pool of LP-led secondaries (~50 per cent), with the remainder to LP primaries, direct/co-investments, and GP-led secondaries. The underlying portfolio companies are sponsored by a wide array of carefully selected private equity managers. This category also includes pure play funds that pursue a focused strategy. This can either be a pure play on private equity LP-led secondaries or direct/co-investment funds that invest most assets (70 per cent+) in underlying private equities directly. GP-led transactions can also be part of the asset mix

- Single-manager funds: including in-house multi-strategy funds, that direct investments across internal investment products and asset classes. The asset mix will largely depend on the strategies of the underlying manager

Increasing access

How should evergreen structures be evaluated in the context of the existing drawdown model of private equity?

Let’s use an analogy – a closed-ended drawdown fund as a vineyard. A vineyard has a vintage – there is a set timeline over which new vines are carefully planted, cultivated, and harvested, after which the (hopefully high-quality) wine is bottled and sold to a buyer. This is a time-tested model that has delivered for clients.

In contrast, an open-ended evergreen fund can be viewed as an orchard. Trees are planted once and then tended to periodically. Fruit is harvested in different seasons and sometimes held back to fully mature. The aim is to earn steady yields and provide ongoing stewardship.

Just as consumers can benefit from having fine wine from a vineyard and cider from an apple orchard, investors can reap the benefits of both drawdown and evergreen private equity funds.

Previously, if an investor wanted diversified exposure to private equity they would have had to invest in multiple fund vintages. Evergreen funds provide a way for investors to acquire private equity exposure with a single commitment and lower operational complexity. However, they do not replace the time-tested drawdown fund model. Ultimately, investors should choose how they want to access private equity based on their capabilities, timelines, goals, and preferences.

Introducing David and Emma

Let’s imagine two hypothetical investors, who are interested in allocating to private equity.

David is a 55-year-old patent lawyer who has worked all his life and accumulated a large amount of savings. He plans to retire in 12 years and wants to invest 10 per cent of his savings in a private equity buyout fund to boost the returns of his pension fund upon retirement. He is an experienced investor and has profited handsomely from prior vintages. He understands that his money will remain ‘locked up’ for five or more years but expects to earn attractive returns when the fund is fully distributed, and he retires.

Emma is a 26-year-old junior doctor with a young daughter who has recently received an inheritance. Emma and her partner would like to withdraw some money in two years to pay for childcare. She is new to investing and has read that private equity offers attractive long-term returns. She likes the liquidity and flexibility offered by evergreen funds, and given her relatively short-time horizon, she can gain exposure quickly with a relatively modest investment. She considers investing some of her savings in an evergreen fund.

Keep David and Emma in mind; we’ll return to them later.

Exploring evergreen funds and drawdown funds

The rise of evergreen funds means investors with different goals, preferences, and investable amounts can gain access to private equity in the way they desire. They can even be utilised together to build a private equity portfolio allocation based on an investor’s desired characteristics.

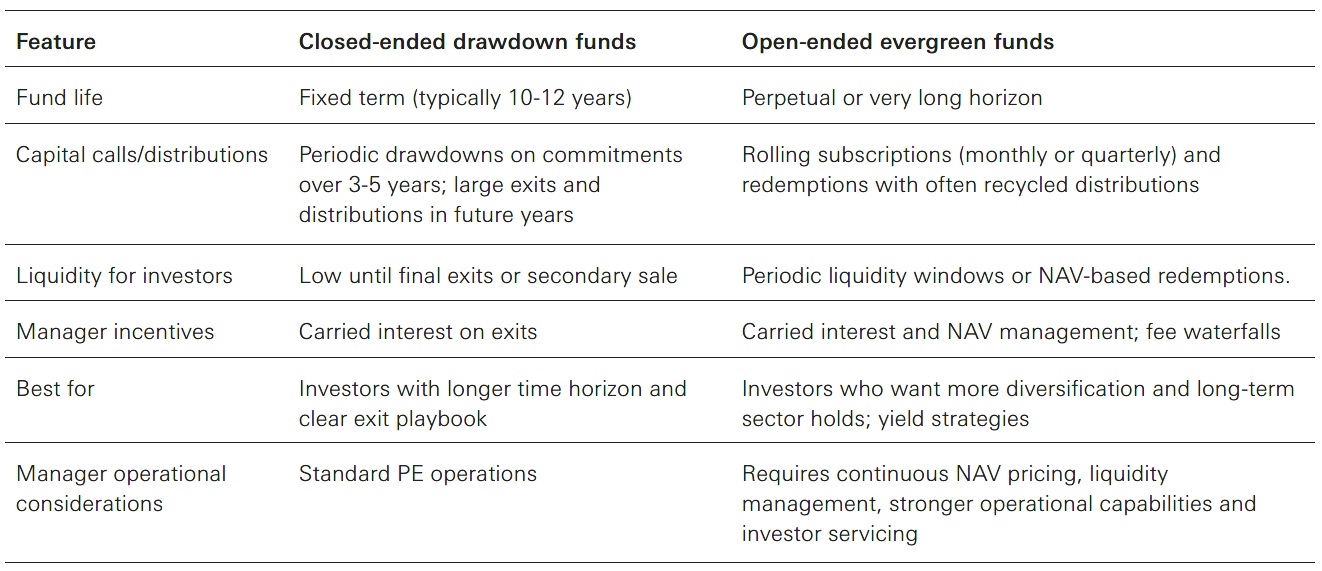

Below is a summary of key features of evergreen and drawdown funds.

Figure 4: Features of closed-and open-ended funds

Six key benefits that evergreen funds can offer are:

- Continuous reinvestment: Given the perpetual nature of funds, there is potential for significant long-term gains from compounding. This aligns with long-term value creation because businesses in many sectors can require more than a decade to unlock full value. Evergreen funds enable GPs to preserve and grow enterprise value and avoid time-pressured exits

- Potential liquidity: For individual investors, this is a significant benefit over traditional funds. Well-run evergreen funds offer periodic liquidity options or NAV-based redemptions, allowing investors to gain private market exposure without their money being locked away for several years

- Enhanced portfolio diversification (for multi-manager funds): Because multi-manager evergreen funds invest in a mix of primary, secondary, and co-investment deals from the outset, they provide greater and faster diversification than a typical primary fund

- Ease of management: Investors contribute capital upfront and transfer the handling future capital calls to the GP. In some cases, evergreen structures can also reduce the financial impact of paying high carried interest in a year, smoothing tax and cashflow implications

- Dynamic asset allocation: The flexibility of being able to shift allocations to the most attractive areas quickly where the investment thesis is more compelling can potentially boost risk-adjusted returns over time

- J-curve mitigation: There are no capital calls over the initial months or years. Instead, the manager aims to fully deploy capital in private markets from the outset. In a multi-manager fund, secondaries and co-investments can be utilised to gain exposure more quickly

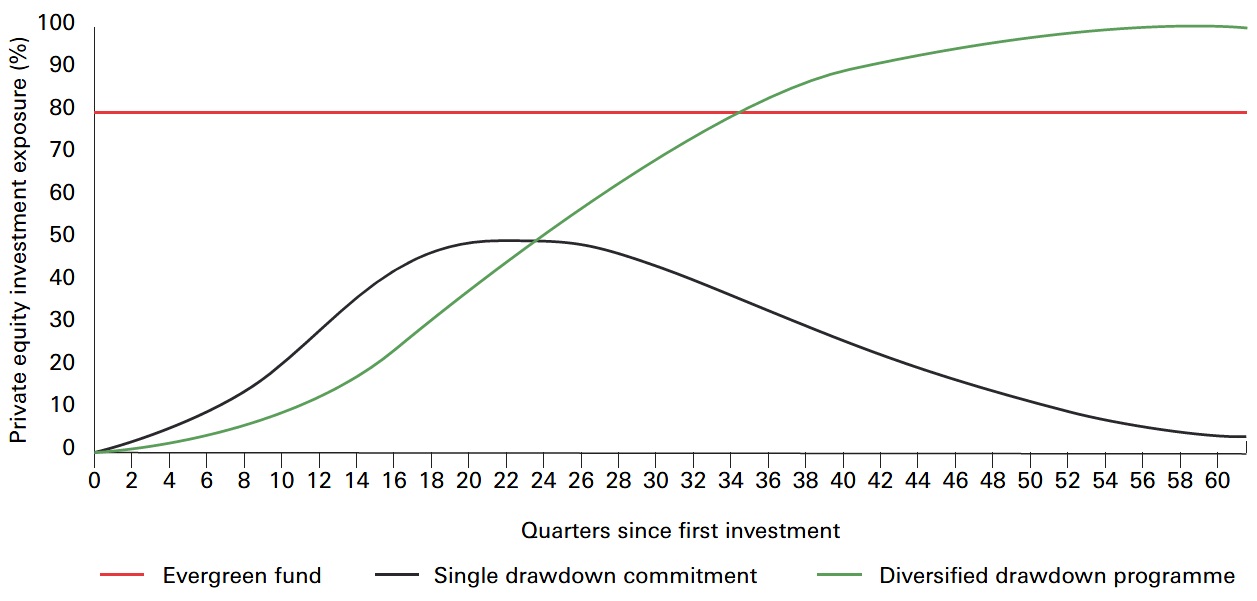

The chart below illustrates the evolution of private equity exposure over time for an evergreen fund versus a single drawdown commitment and a diversified drawdown programme.

Figure 5: Private equity exposure for evergreen and drawdown funds

Source: HarbourVest Partners (2025).

Typically, evergreen funds provide immediate and significant private equity exposure from the outset. Exposure is maintained perpetually as distributions from company exits are recycled into new deals, compounding returns over time. The GP retains a liquidity sleeve such as cash and yielding liquidity instruments to meet client redemptions. The liquidity sleeve can create cash drag over time, impacting the performance of evergreen funds versus equivalent drawdown funds.

A single drawdown commitment or vintage and a diversified drawdown PE programme both invest predominantly in primary deals. In a single commitment, capital is deployed and exposure gained over around five years, while a diversified drawdown PE programme can take 15 years to gain 100 per cent exposure. Distributions are made to the investor as investments are exited and are not usually recycled.

Secondaries and co-investments

Multi-manager evergreen funds can provide immediate exposure and partial liquidity because of their sizeable allocation to secondary investments. As we saw, primary investments can take five or more years to start distributing, but because secondaries purchase existing assets, distributions tend to come in earlier. They provide greater liquidity and allow quicker exits as the assets are more mature. With secondaries, investors can also invest in proven assets that have a track record and history, helping to avoid the blind pool risk associated with primary investments. Finally, acquiring multiple secondary stakes across sectors and geographies allows for greater diversification than single primary investments.

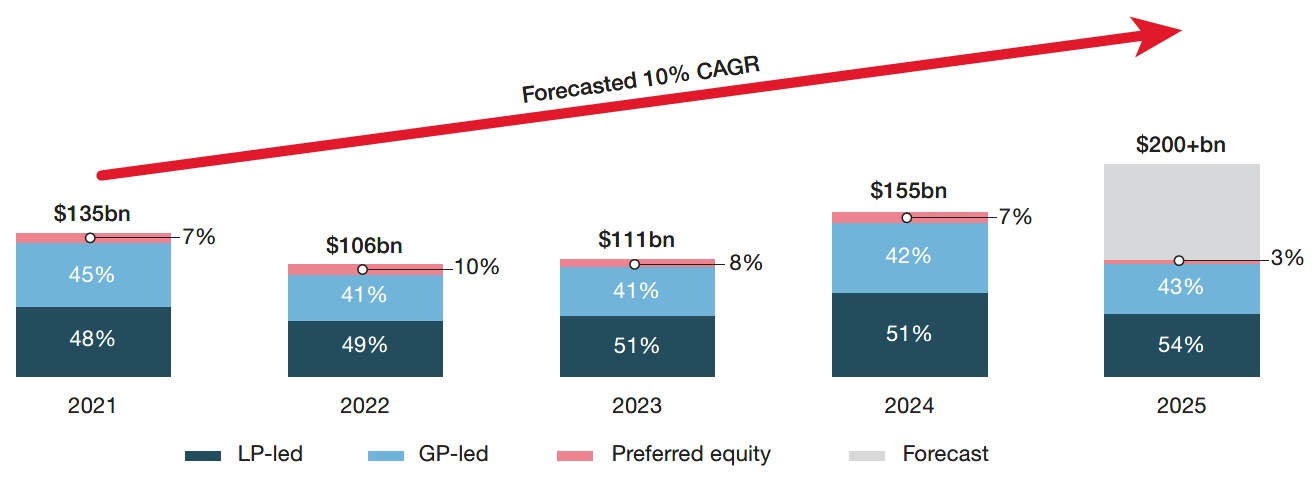

These multiple benefits explain why investors have been drawn to GP-led and LP-led secondaries. There has been a significant rise in secondaries volume over the last two years, particularly as exits and distributions from traditional drawdown funds have remain subdued. Secondary transaction volumes reached USD 110bn in H1 2025, a 59 per cent increase from H1 2024, and are expected to reach USD 200bn by the end of 2025.

Figure 6: Annual secondary market volume (2021-2025)

Source: Campbell Lutyens (2025).

The rise of evergreen funds has been enabled by the growth of secondaries fundraising and dealmaking, as well as GP- and LP-led exits. We expect this trend to continue as the primary market remains subdued amid an uncertain market environment.

An added benefit of evergreen funds is that they commonly invest in co-investment deals. In co-investments, the fund manager selectively participates in deals sourced by other fund managers. This provides LPs with much-needed diversification, stronger relationships with GPs, and potential fee savings.

Evaluating evergreen fund returns

With traditional drawdown funds, the key performance metric is internal rate of return (IRR). This is a money-weighted rate of return that captures the impact of the GP’s active decisions regarding the timing of capital calls, exits, and distributions over multiple years.

In contrast, evergreen funds are open-ended funds that have continuous calls and distributions. Cashflows are not under the GP’s control, making IRR an unsuitable measure. A total, or time-weighted, rate of return provides a more accurate reflection of a GP’s skill – and a fund’s performance – because it is not skewed by factors such as large investor deposits during bullish markets or withdrawals during bearish markets. This is why a time-weighted approach is also used to calculate the performance of traditional equities and bond funds.

Care is warranted when comparing the performance of evergreen and drawdown funds because IRR and total return are not directly comparable. Instead, multiple on invested capital (MOIC) can be used as a common measure to calculate the return generated on capital invested, irrespective of cashflow timing.

However, even using this measure, there are many assumptions inherent in calculating evergreen fund returns that make direct comparisons problematic. These include cost of capital for uncalled amounts; the operational cost to manage liquidity; the timing of reinvestment; structural differences in the administration of fees and carry; and investor behaviour through recessionary periods3.

Overall, research shows that the long-term return differences between drawdown and evergreen funds is largely a factor of the timing of cashflows and reinvestment4. An investor in an existing private equity programme that is capital-efficient in its cash management may want to maintain a programme with continuous commitments, which may generate higher returns over time. However, an investor considering building a new private equity portfolio may want to utilise an evergreen fund to enable immediate and continuous deployment, allowing for compounding of returns over time.

Investor considerations

Aside from returns, key considerations include your individual circumstances, preferences, and goals, and the capabilities of the fund manager. Below is a checklist for investors evaluating private equity evergreen managers and funds.

- Time horizon

Do you prefer a defined investment time horizon of around 10 years or investing perpetually? - Liquidity needs

Do you require the option for liquidity? Evergreen funds can offer periodic liquidity, but take notice of redemption frequency, gates, notice periods and other liquidity terms - Single or multi-manager fund

Single-manager evergreen funds typically reflect a GP’s established and specialised investment strategy, with the GP controlling and operating each portfolio company. They are commonly used as satellite investments.

Multi-manager evergreen funds leverage extensive GP networks to access diverse co-investments and secondaries. This enables them to build diversified portfolios across multiple managers within a single fund. They are commonly used as core, diversified component of a portfolio - Tax and estate planning

Are you exposed to specific taxes from your private equity investments?

The timing of fees and exits may impact on tax planning, so you may need to consult tax experts - Evaluating evergreen fund managers

There are several considerations when selecting an evergreen fund manager, many of which are common to closed-ended drawdown funds.- Liquidity management: How does the manager balance cashflows and deployment? Are distributions automatically reinvested or paid out and what are the impacts on compounding of returns?

- Portfolio construction: Is there a clear strategy ensuring sustainable growth and diversification?

- Deal flow and deployment: How strong is the primary, secondary and co-investment deal flow pipeline? Does the manager maintain a consistent investment pace? Do the manager’s evergreen funds have access to the same deals and allocations as its drawdown funds?

- Track record: Does the manager have experience in operating evergreen funds, and if so, what is the performance history?

- Fee structure: Are fees charged on NAV, commitments, or invested capital, and are there are any entry or exit fees?

- Valuation approach and operational capability: Valuation is a wide topic and could warrant a separate paper. Evergreens require more frequent valuation assessments compared to traditional closed-ended funds given the need to meet redemptions. Is the manager transparent about its valuation process, and is it rigorous and disciplined? Are valuations based on internationally accepted accounting standards? Can the managers calculate continuous NAVs in real-time? This is especially important for primary and secondary investments, where the manager relies on quarterly assessments from asset owners. Does the manager seek independent third-party valuation to verify its assessments? Finally, does the manager provide a high level of client servicing?

Returning to David and Emma

As retirement approaches, David wants to spend more time managing his investments. He would like control over how and whether he reinvests distributions. Being a patent lawyer, he has a long-held interest in technology.

Consequently, David decides to invest the core of his private markets’ allocation to a multi-manager technology-focused drawdown fund that is agnostic to geography and sector. He aims to reinvest some of the distributions from the drawdown funds into a single-manager evergreen fund over time to maintain his desired NAV and to provide liquidity to fund expenditures in retirement.

Meanwhile, Emma has been busy working as a doctor and has little time to research investments. She likes that evergreen funds are less burdensome, and that the manager is responsible for managing cashflows and reinvestment. Equally, she thinks traditional drawdown funds suit her long-term investment horizon. She’s also passionate about the potential for healthcare to save lives and would like to express this in her portfolio.

She opts for a core-satellite approach, the core being a multi-manager evergreen fund and a satellite investment in a healthcare-focused single-manager drawdown fund through a feeder vehicle. Using this approach, she plans to use a portion of the redemptions to pay for childcare expenses and the rest to meet capital calls of the drawdown fund over time.

Adding to the investor toolkit

These hypothetical investors illustrate how open-ended evergreen funds complement closed-ended drawdown funds by offering alternative portfolio solutions to investors with different goals, requirements, and time horizons.

Consequently, we expect evergreen funds to continue to gain in popularity and become increasingly mainstreamed as a core component of the private markets landscape.

1. These figures apply to all evergreen funds, not just private equity.

Any forecast, projection or target where provided is indicative only, and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

2. Rise of private equity evergreens: Moving from IRRs to time-weighted returns - Scientific Infra & Private Assets (SIPA) – SIPA (2025).

3. Three common questions about when and how to use evergreen and drawdowns in private equity programs - HarbourVest (HarbourVest, 2025).

4. Z0564_0824_Comparing_evergreen_and_traditional_fund_returns_posting (7).pdf (Neuberger Berman, 2024).

Any forecast, projection or target where provided is indicative only, and is not guaranteed in any way.

HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Key risks

- Alternatives risk: There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily reliable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements

- Equity risk: Portfolios that invest in securities listed on a stock exchange or market could be affected by general changes in the stock market. The value of investments can go down as well as up due to equity markets movements

- Interest rate risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements

- Counterparty risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

- Derivatives risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

- Emerging markets risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks

- Exchange rate risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly

- Investment leverage risk: Investment leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source

- Liquidity risk: Liquidity risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors

- Operational risk: Operational risks may subJect the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things

- Style risk: Different investment styles typically go in and out of favour depending on market conditions and investor sentiment

- Model risk: Model risk occurs when a financial model used in the portfolio management or valuation processes does not perform the tasks or capture the risks it was designed to. It is considered a subset of operational risk, as model risk mostly affects the portfolio that uses the model

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Obtain information about the state guarantee to deposits at your bank or on www.cmfchile.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

Copyright © HSBC Global Asset Management Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D057584_v1.0; Expiry date: 31.10.2026.