Framework for a resilient future

With HSBC Infrastructure Equity Strategy

Read moreHSBC Infrastructure Equity Strategy – Capitalising on long-term themes and capturing emerging opportunities

The HSBC Infrastructure Equity strategy has a more balanced exposure to the four macro infrastructure sectors. Outside of large cap stocks, the dedicated infrastructure investment team also scours attractive opportunities in the urbanisation, energy transition and digitalisation areas. Whether you are looking to deepen your existing allocation or re-allocate to infrastructure, HSBC Infrastructure Equity strategy can offer potential opportunities.

Long-term themes

Urbanisation

|

Energy transition

|

Digitalisation

|

Short-term themes

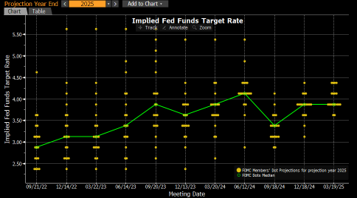

Evolution of interest rates expectations

|

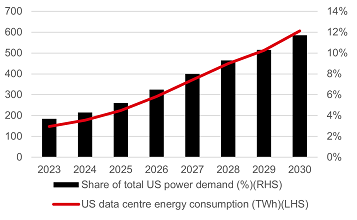

Higher power demand driven by AI and onshoring of manufacturingDemand for power for data centers is expected to rise significantly

Why it matters?

|

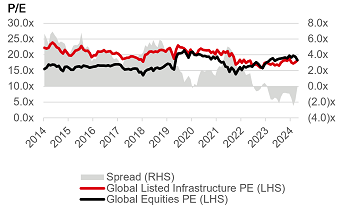

Global markets relative valuation

|

|

Source: HSBC AM, Bloomberg as of March 2025 |

||

Focus on Infrastructure Equity

|

Inflation hedge Real assets potentially providing a natural hedge in inflationary environment |

Income Long duration assets generating potentially high distribution levels |

Liquid Liquidity providing immediate exposure to core infrastructure assets |

Defensive Defensive building block to a diversified equity portfolio |

Growth Secular growth pathway driven by a multi-decade investment cycle |

|

|

||||

Sectors we invest in

At HSBC Asset Management, we focus on four sector verticals:

|

Communications

|

Energy infrastructure

|

Transportation

|

Utilities

|

Source: HSBC Asset Management. For illustrative purposes only. This information shouldn't be considered as a recommendation to invest in the specific sectors mentioned.

The strategic advantages of Listed Infrastructure Equity

Getting to know Listed Infrastructure

Want to know more about Listed Infrastructure as an asset class? Hear from Portfolio Manager Giuseppe Corona on the distinct benefits of our Global Listed Infrastructure capability and the philosophy that sets it apart.

Insights from our experts

Outlook for Listed Infrastructure sector

Discover why Global Listed Infrastructure can offer investors a defensive building block in the current market landscape. Joe Little, Global Chief Strategist, explores the benefits of the asset class including its lower correlation to global equities, and steady income potential.

Dislocation between price & value – Causes & implications

Since 2022, Global Listed Infrastructure has shown a marked dislocation between price and value. While companies have continued to deliver solid earnings and income, valuations have been muted, particularly in comparison to private infrastructure markets. Giuseppe Corona, Head of Listed Real Assets, explores the causes and implications of this divergence in our latest video.

Resources

Click on the links below to explore more insights

|

Powering AI

|

Read time: |

|

|

Investing in Global Listed Infrastructure Equity

|

Read time: |

|

|

Tariffs, Taxes, Trump and Transmission

|

Read time: |

|

|

Global Infrastructure Equity – A defensive building block

|

Read time: |

HSBC Asset Management

Strong experience

|

Dual research hub – London and Sydney

|

||||||||

|

Source: HSBC Asset Management as of March 2025. The investment team may change from time to time without notice. |

|||||||||

Investment team

|

Giuseppe Corona Head of Listed Real Assets Giuseppe Corona is the Head of Listed Real Assets at HSBC Asset Management, based in the London office. He joined the financial industry in 1999 and began portfolio management across long only and long/short products in 2008. Mr. Corona moved to HSBC Asset Management in March 2022, to launch its Listed Infrastructure Equity capability. Prior to joining HSBC Asset Management, he has worked across roles covering multi-utilities and infrastructure companies, including managing long/short market neutral portfolios, a US large cap value fund and a European hedge fund. Mr. Corona holds a Bachelor of Economics and Business Administration from the University of Palermo in Italy and a Master of Business Administration in International Finance from St. John's University in Italy. He is also a CFA charterholder. |

Key Risks

- Equity Risk: Portfolios that invest in securities listed on a stock exchange or market could be affected by general changes in the stock market. The value of investments can go down as well as up due to equity markets movements.

- Interest Rate Risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements.

- Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

- Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

- Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

- Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

- Investment Leverage Risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

- Liquidity Risk: Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

- Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

- Style Risk: Different investment styles typically go in and out of favour depending on market conditions and investor sentiment.

- Model Risk: Model risk occurs when a financial model used in the portfolio management or valuation processes does not perform the tasks or capture the risks it was designed to. It is considered a subset of operational risk, as model risk mostly affects the portfolio that uses the model.

- Alternatives: Alternative investments include Private Equity, Commodities, Hedge Funds and Property. They may be difficult to sell in a timely manner or at a reasonable price. It may be difficult to obtain reliable information about their value.

- Sustainability Risk: Sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment.

Important Information

Past performance is no guarantee of future returns. The return, the value of money invested in the fund may become negative as a result of price losses and currency fluctuations. There is no guarantee that all of your invested capital can be redeemed.

Representative overview of the investment process, which may differ by product, client mandate or market conditions.

Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

The commentary and analysis presented in this document reflect the opinion of HSBC Asset Management on the markets, according to the information available to date. They do not constitute any kind of commitment from HSBC Asset Management. Consequently, HSBC Asset Management will not be held responsible for any investment or disinvestment decision taken on the basis of the commentary and/or analysis in this document.

Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.